Table of contents

- Overview

- About Stripe

- Supported payment methods

- Stripe Payouts

- Fees

- Refunds

- New: payment attempts

- Stripe dashboard and reports

- FAQs

- The takeaway

Overview

This article provides a comprehensive overview of Stripe, including its supported payment methods, payout details, fees, and refund processes. It also guides you through the Stripe Dashboard's functionalities and touches upon anticipated future platform developments.If you're looking for the setup instructions, please refer to this article: Set up Stripe Express

About Stripe

Stripe is a widely trusted payment provider that processes over $1 billion in payments. GotPhoto has used Stripe Connect for payments in the United States, Canada, and the United Kingdom. Since September 2023, Stripe Express has become GotPhoto's exclusive payment system.

What are some advantages of Stripe Express?

- Reliability and security from one of the largest payment providers in the world.

- New payment options, such as Google Pay and Apple Pay.

- Fast confirmation and processing of payments allow your orders to be processed as quickly as possible.

- More convenience: Refunds to your customers can be issued directly from your GotPhoto admin area.

- Ability to access and manage your Stripe settings directly from your GotPhoto admin area.

Supported payment methods

Stripe Express supports various payment methods, offering flexibility for your customers.

You will be able to receive payments by:

You will be able to receive payments by:

- Credit/debit card

- Apple Pay

- Google Pay

- [Optional] Offering Apple and Google Pay is optional. These payment methods are activated by default and can be turned off in your Stripe Express settings ("Modify"). However, GotPhoto highly recommends activating them as they are widely used payment apps. The availability of these two additional payment methods in your shop depends on your customers' browsers (Apple Pay will be shown in Safari, Google Pay in Google Chrome) and account settings. To see these options, customers need a valid credit card saved in their Apple Pay/Google Pay account. It's also crucial for customers not to use incognito mode and to enable the browser setting that allows sites to check for these saved payment methods.

- Klarna - pay now buy later [US only]

Similar to Apple and Google Pay, you can activate Klarna under Payment Methods > Stripe Express > Modify. At this point, Klarna is not available in the UK and Canada.- Payment options with Klarna: Depending on your region, Klarna offers Pay Now, Pay Later, Pay in X installments, and financing options. Availability is fully determined and controlled by Klarna. There are no additional fees for using these options other than Klarna's payment fees (see below).

- Availability for your customers: Klarna is available for orders over 50 USD/CAD, including taxes and discounts, offering flexible payment options. During our initial beta rollout, the minimum order amount cannot be changed, but GotPhoto welcomes your feedback and will adjust as needed. Please let us know if this limitation doesn't work for you.

- Payment fees: The payment fees for Klarna differ from those of other payment options. Each order incurs a flat fee of $0.30, along with a volume-based fee of 5.99% per transaction.

- Receive the full payment immediately: Payment is subject to standard processing delays and restrictions. You don’t have to wait for the customer to pay off the loan- you’ll receive the payment immediately. Klarna takes on the financial risk of the transaction, which is reflected in the higher payment fees associated with this option.

- Loan eligibility: Klarna controls loan eligibility and may decline installment payments based on various factors. GotPhoto cannot assist or access this decision process.

- Additional information: For up-to-date information, please refer to Klarna’s website, especially their "How it Works" and "Help" sections, for any questions regarding Klarna’s operations..

- Stripe link

Similar to Apple and Google Pay, Stripe Link is a digital wallet that allows your customers to make payments via a securely saved credit/debit card (US, CA, and UK) or via Instant Bank Payments through their bank account (US only). Stripe Link is enabled by default.

The first time a customer enters their credit card (US, CA, and UK) or bank details (US only) during checkout, Stripe will ask them if they'd like to securely save their payment information for future use. If they agree, they will receive an email asking them to verify their email. On their next purchase with you or any other online shop offering Stripe Link, Stripe will automatically retrieve their saved details, streamlining the checkout process for them.

For Instant Bank Payments (US only), Stripe provides customer incentives, such as a $5 rebate on qualifying orders, funded directly by Stripe with no impact on you. No action is required from your platform or business. Offers may change as Stripe runs experiments. Customers see the rebate on their bank statements. Promo details are visible at checkout, with terms at Link.com. Additional information on Instant Bank Payments is available through Stripe Support.

- PayPal will no longer be supported after August 31st, 2023. In a carefully conducted experiment involving over 30,000 orders, GotPhoto found that the availability of PayPal as a payment option had no impact on the conversion rate into purchases. Regardless of whether PayPal was available or not, 95% of customers in both groups made a purchase, leading us to conclude that the existing payment mix adequately satisfies customer demand without affecting the order rate or average order value

Stripe Payouts

After the customer pays for their order and the bank releases their money, it will instantly become available on your Stripe account. GotPhoto will withdraw service and payment fees directly at the time of payment.

Payouts are issued weekly (per default on Mondays).

You are a new GotPhoto customer and just created your Stripe account? Please note that for the first 31 days after your first order, the payout schedule is fixed. After that period, you will be notified via email that you can adjust your payout settings at any time. Learn more about your options below.

Here’s the fastest way to get to your Stripe payout settings page:

Here’s the fastest way to get to your Stripe payout settings page:

1. At the bottom of your GotPhoto dashboard, click the amount shown under Stripe Express.

2. From the dropdown menu, select Request payout.

4. A pop-up appears where you can update your payout schedule.

Under "See Details," you can find more details about available funds.  When clicking "Update," you will find the option to update your payout mode based on your preference. Learn more below.

When clicking "Update," you will find the option to update your payout mode based on your preference. Learn more below.

- Below your Wallet details, you find a list of your previous payouts.

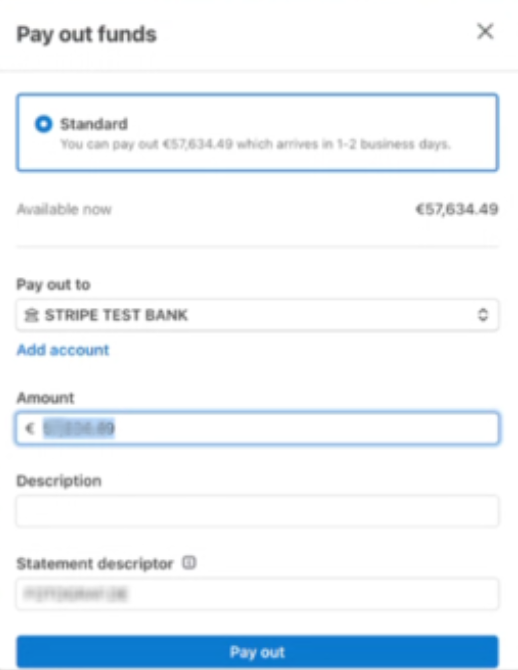

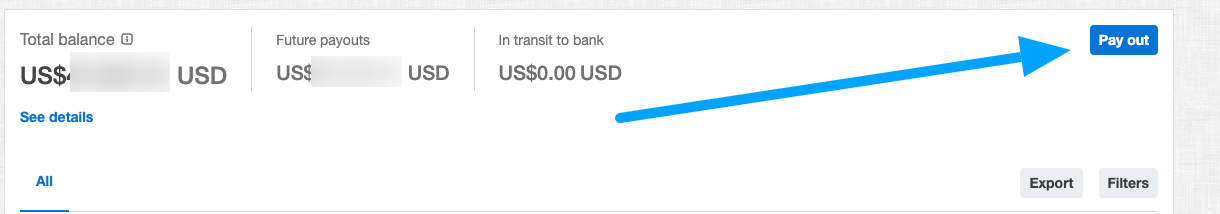

Press the "Pay out" button to initiate a payout. In the next step, you can adjust the amount if you do not wish a full payout. If you don't see the "Pay out" button, it means that you're still on the default settings, the automatic weekly payout schedule. Click "See Details" then "Update" to change the settings.

Updating your payout settings

After 30 days from your first paid order, you’ll be able to adjust your payout settings to match your preferences.

You can select between a manual and an automatic payout.

You can select between a manual and an automatic payout.

- If you select the manual payout option, you can request a full payout whenever there is a positive balance. The minimum amount for a payout is $1.

- For automatic payouts, you have full control of the payout schedule. By default, it will be a weekly payout on Mondays. Please note: However, you can adjust it to be monthly (payout day will be the third) or a weekly payout (you can select your preferred working day for the payout). The funds should be transferred to your bank account within three business days. Your very first payout typically takes a couple of days longer because of Stripe's verification process. There are no additional charges associated with the payout. Once a payment is on the way to you, you will receive a text from Stripe that will notify you about the upcoming payout.

Please note that until the payout is completed and the payment is marked as settled, it will be shown as pending on your Stripe dashboard. Pending does not mean that your customer has not yet paid; it means the amount is not yet available for a payout. Clicking on the payments that are currently processed in your account will show you the total of payments that have not yet been paid out and payments that have been sent to your payout account.

Please note that until the payout is completed and the payment is marked as settled, it will be shown as pending on your Stripe dashboard. Pending does not mean that your customer has not yet paid; it means the amount is not yet available for a payout. Clicking on the payments that are currently processed in your account will show you the total of payments that have not yet been paid out and payments that have been sent to your payout account.

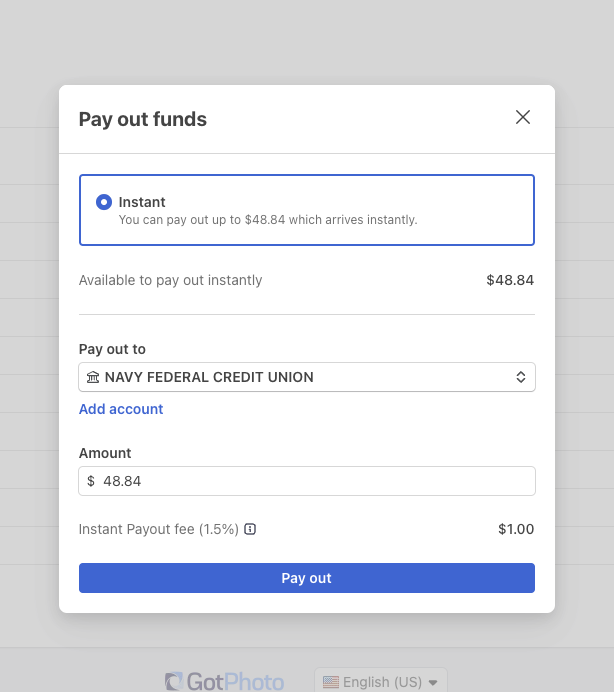

Instant payouts

Instant Payout is a feature on the Stripe platform that allows you to transfer funds from your Stripe account to your bank account almost immediately, bypassing the typical 3-5 business day wait. This feature is only available for US accounts.

Eligible users can request an Instant Payout anytime, including weekends and holidays, with funds generally settling in the associated bank account within 30 minutes. This feature offers increased flexibility and quicker access to funds, making it a valuable tool for businesses needing fast cash flow management.

Availability: Instant Payouts are available to US accounts meeting the following criteria:

- The account must be older than 30 days.

- The account must have already made at least one Stripe payout.

The account must have an Instant-eligible payment method associated with it. Currently, only debit cards and certain banks qualify for Instant Payouts. The list of eligible banks can be accessed here. Instant-eligible payment methods are marked as such when viewed in the Stripe Dashboard or the Payouts page in the GotPhoto admin area.  Limitations: In addition to the eligibility requirements, Stripe limits the availability and maximum amount for Instant Payouts. These limits can vary depending on several factors, such as account history, transaction volume, and risk assessments performed by Stripe. As a result, the total amount available for an Instant Payout may differ from one account to another and may change over time based on the account's activity and standing with Stripe.

Limitations: In addition to the eligibility requirements, Stripe limits the availability and maximum amount for Instant Payouts. These limits can vary depending on several factors, such as account history, transaction volume, and risk assessments performed by Stripe. As a result, the total amount available for an Instant Payout may differ from one account to another and may change over time based on the account's activity and standing with Stripe.

Request an instant payout: Instant Payouts can be requested from the GotPhoto admin areas, via the Payouts page. By clicking the "Pay Out" button, you will be able to choose the Instant Payout option if available.

Paused Stripe Payouts

In case you see the note Your payouts are temporarily paused in your payout settings: We’ve temporarily paused payouts on your Stripe account while we review some unusual activity. This is a standard safety measure to help protect your funds.

If you encounter this message in your payout settings, a review by our Customer Care team is required to continue payouts.

Fees

Instant Payouts on the Stripe platform incur a fee of 1.5% of the payout amount, with a minimum fee of $1 USD. This fee is clearly displayed on the payout confirmation page, ensuring that you have all the necessary information to make an informed decision before proceeding with the Instant Payout.

How will my fees be deducted?

Fees are deducted differently depending on your region.

| US Customers | Canadian Customers | UK Customers |

GotPhoto automatically deducts any service and payment fees (called “payment split”). The rest will be deposited into your Stripe account. Any services not covered as part of the payment split (such as self-order fees) will be billed separately. Your monthly invoice from GotPhoto shows a breakdown of the charges. Service and payment fees will be displayed separately. | 1. You created your account before May 14, 2025: GotPhoto charges all fees at the end of the month with your monthly invoice. 2. You created your account on or after May 14, 2025: GotPhoto automatically deducts any service and payment fees (called “payment split”). The rest will be deposited into your Stripe account. Any services not covered as part of the payment split (such as self-order fees) will be billed separately. Your monthly invoice from GotPhoto shows a breakdown of the charges. Service and payment fees will be displayed separately. | GotPhoto automatically deducts service, payment, production, and shipping fees from your customers' payments. Shipping fees for Batch Orders will be charged to your card. |

More information on your GotPhoto fees can be found here. In North America, your lab will bill you directly for production and shipping fees. In the UK, GotPhoto will bill your production and shipping fees instead of the lab.

When my monthly fees are due (covering subscription charges), will the amount be deducted from my Stripe balance, or will it be charged to the credit card I have provided on file?

If you have set up the automatic payout schedule, the charge will be processed on the credit card you have on file. GotPhoto will charge your Stripe balance if you select the manual payout option. However, GotPhoto will charge your credit card for the full sum if your Stripe balance has insufficient funds.

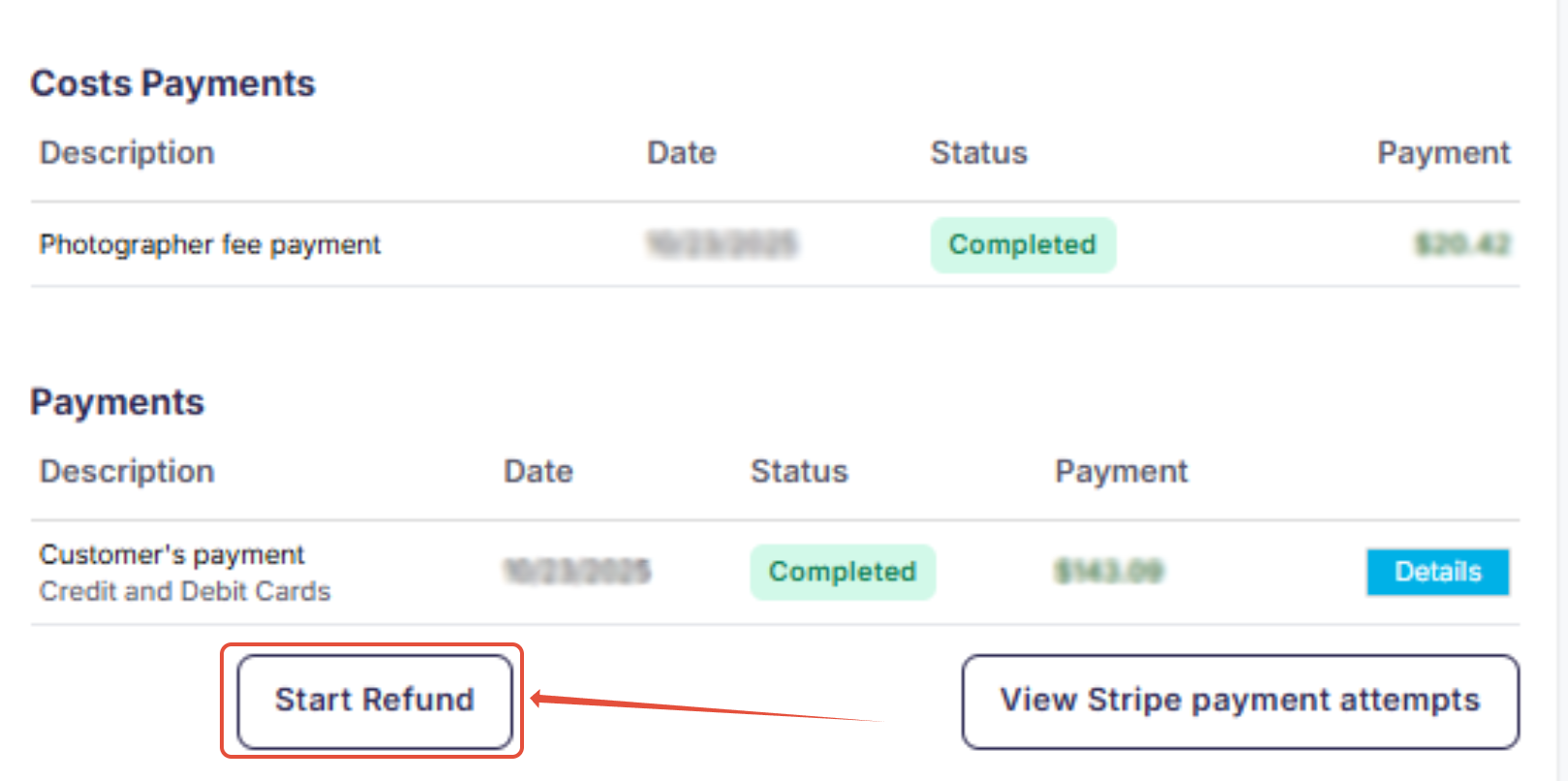

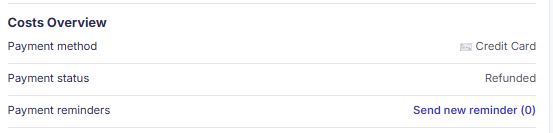

Refunds

You can refund the order completely or partially using the dashboard. Simply visit the order details page and click the “Start Refund” button. Please note that you are still liable for any payment or service fees. They will be deducted from your customer's payments even if you later refund the full order amount to the customer.

It can take a few minutes for the refund to appear on the order page. If a partial refund has been applied, the order status will now show as 'Partially refunded.'

After the refund has been issued, your customer will receive a confirmation email that notifies them about the refund. On your customer's bank statement, the refund amount will show the statement descriptor that you have set up under Payment methods > Stripe Express > Modify.  Please note that the order won't be automatically canceled in GotPhoto if you issue a refund. Please review this article if you also need to cancel the order.

Please note that the order won't be automatically canceled in GotPhoto if you issue a refund. Please review this article if you also need to cancel the order.

An order was refunded or partially refunded and the customer still needs access to their ordered products or downloads? Please review this article.

What about customer payment disputes?

If a customer disputes a payment, GotPhoto will hold the payment, and Stripe will charge a non-refundable dispute charge of $15. Once the dispute is resolved and proven incorrect, the order payment will be credited back to your account.

My customer received an error message when attempting to pay with their credit card.

Your customer will see the reason why the card payment failed. Here, you can find an overview of all possible errors that can occur.

Payment attempts

Discover the new feature that allows you to see all payment attempts for an order.  On any given Individual Order Page, you will now find a button titled View Stripe payment attempts. Clicking this button will open a window that shows all attempts at payment by your customer. If a Details button appears, clicking on it will provide more information about the attempt.

On any given Individual Order Page, you will now find a button titled View Stripe payment attempts. Clicking this button will open a window that shows all attempts at payment by your customer. If a Details button appears, clicking on it will provide more information about the attempt.

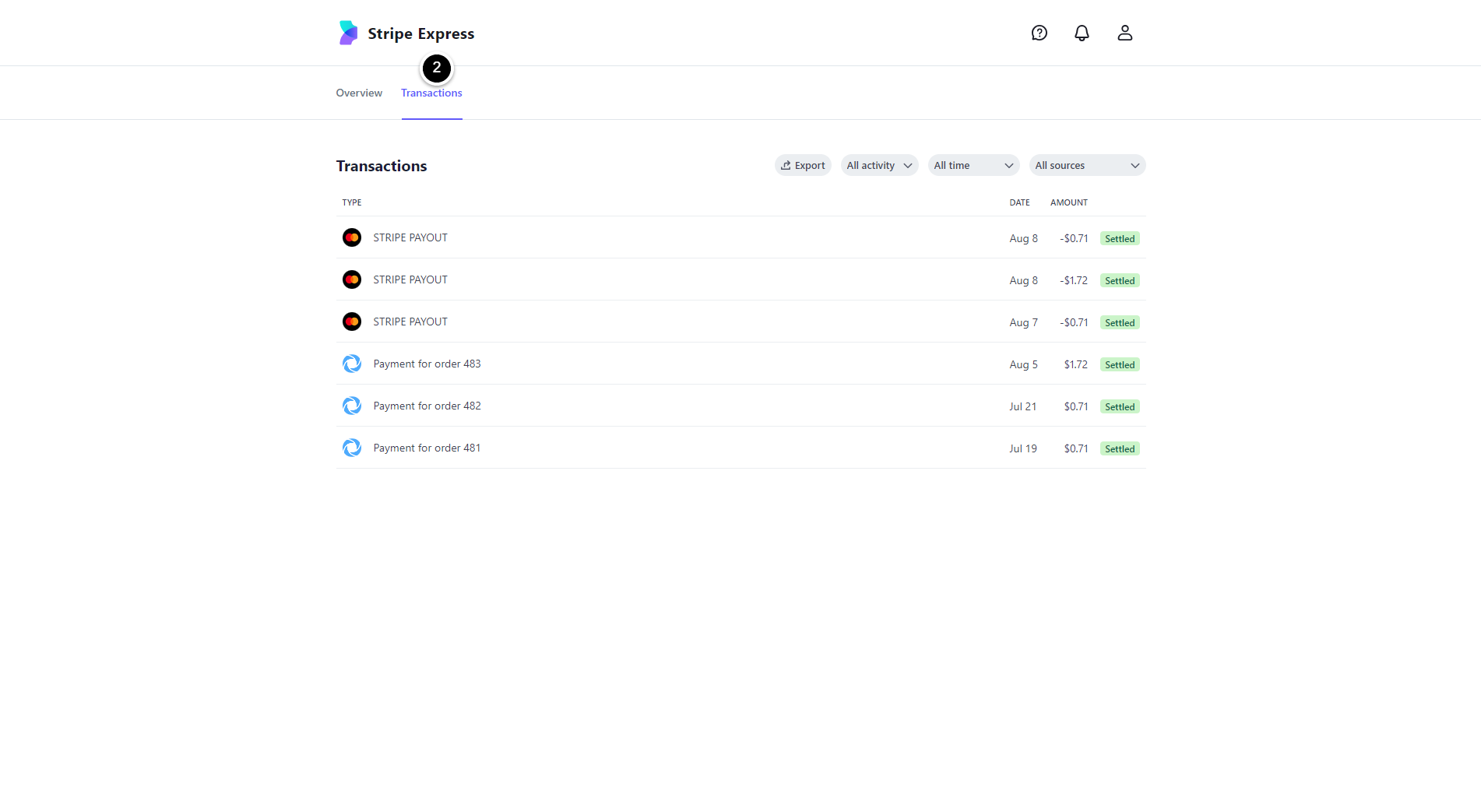

Stripe dashboard and reports

Explore the functionalities of your Stripe Dashboard and access various financial reports.

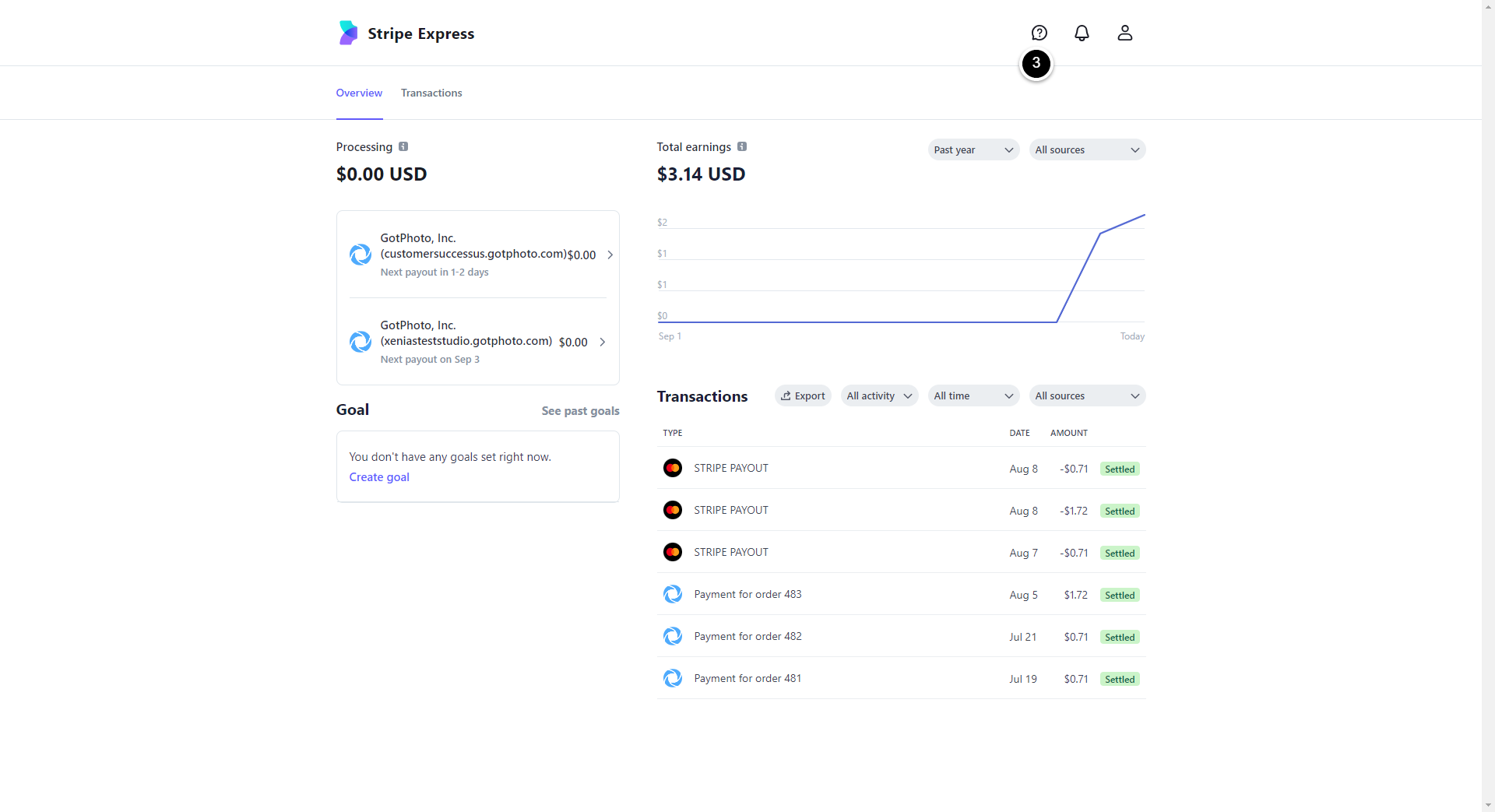

What does the Stripe dashboard look like?

In addition to all the reports and statistics available in your GotPhoto account, you will have access to your Stripe Dashboard. There, you can view your earnings statistics, track payouts, and adjust settings related to your verification documents and bank accounts. If you have already used Stripe in the past, this will all look familiar to you.  The Stripe Dashboard also includes a link to Stripe's help desk, where you can find detailed help articles.

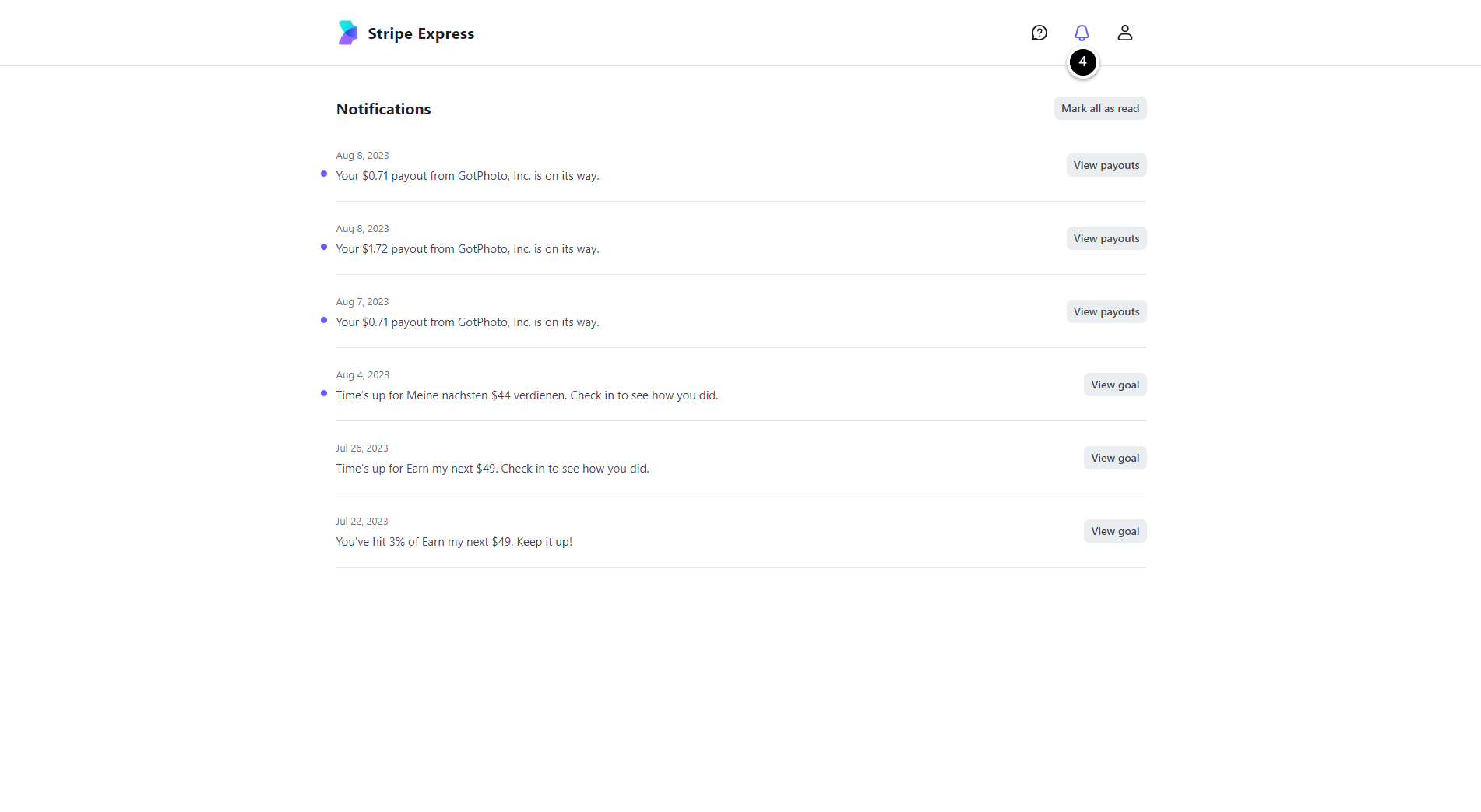

The Stripe Dashboard also includes a link to Stripe's help desk, where you can find detailed help articles.  You can find your notifications under one quick view:

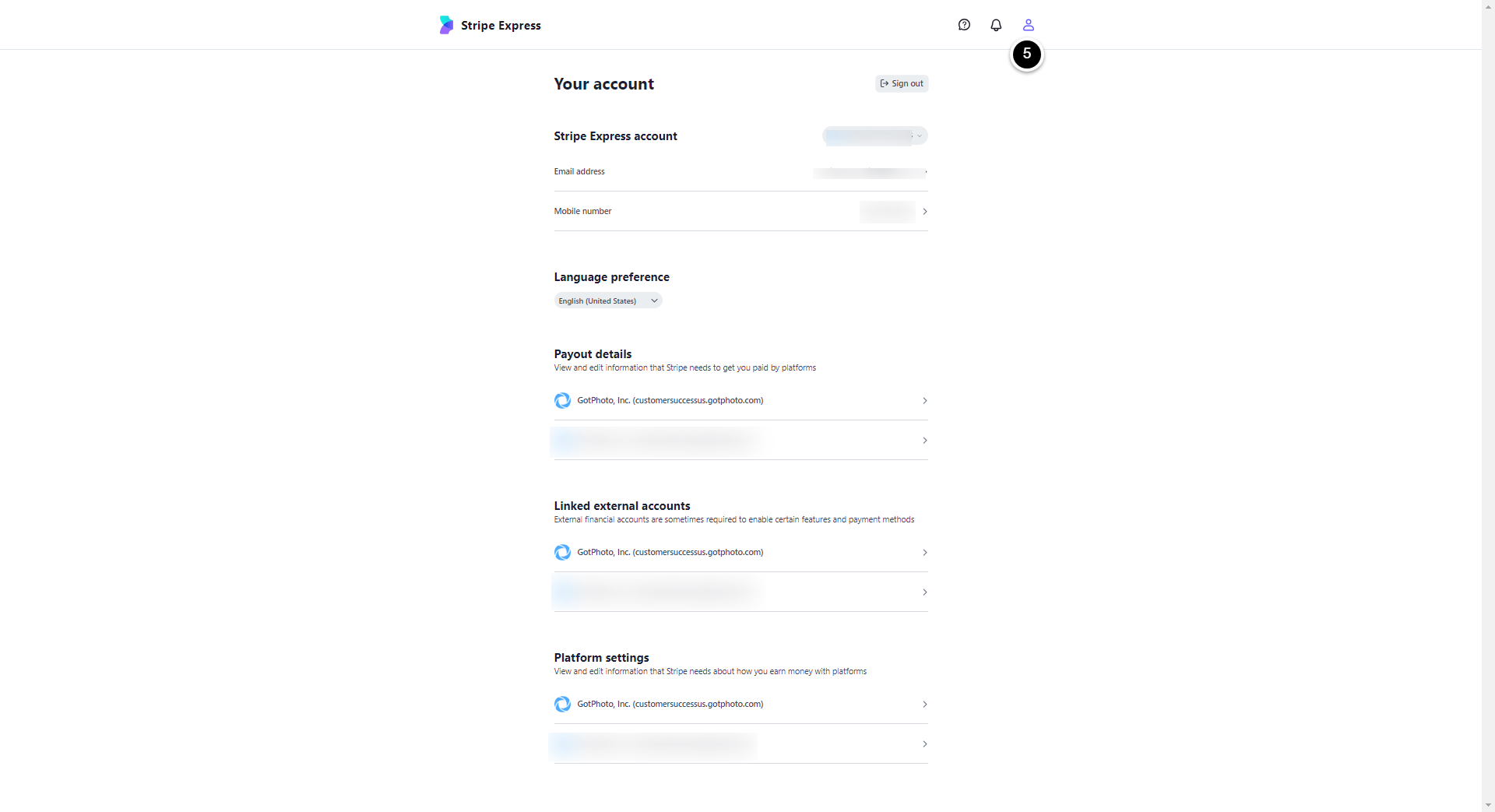

You can find your notifications under one quick view:  Under the user icon, you have the option to review your account, payout, and platform settings:

Under the user icon, you have the option to review your account, payout, and platform settings:

On my GotPhoto dashboard, I can see my current balance. What do Stripe Express and GotPhoto Balance mean here? And why do the amounts change so frequently?

- Current Stripe Express balance: These funds in your Stripe Express account are available for a payout.

- Current Balance Gotphoto: You earned this amount recently, but it’s not yet deposited in your GotPhoto account. It's important to understand that this is a rolling balance, meaning it continuously changes and can be both positive and negative depending on various factors.

- Positive balance: A positive balance can result from several scenarios, including:

- Overpayments of fees: If you paid more in fees than you owe, the excess amount is reflected as a positive balance.

- Refunds for issues: If refunds are processed for any reason, they can contribute to a positive balance.

- Manual pay-ins: When users manually add funds to their accounts, it increases their balance.

- Negative balance: On the other hand, a negative balance can occur for reasons like:

- Pending billables: Fees or charges may accumulate in the account balance before they are invoiced or billed (e.g., editing service fees). This can temporarily lead to a negative balance.

- Ongoing transactions: The balance can change frequently due to ongoing transactions, payouts, payments, and fees.

It's important to note that the GotPhoto balance shown in your dashboard is not the same as the Stripe balance. Billing and invoicing are handled via the GotPhoto balance, which can fluctuate as transactions occur. In summary, the rolling balance can be positive or negative based on various financial activities and transactions within the platform, and it is part of the system's features to provide users with a real-time view of their account's financial status.

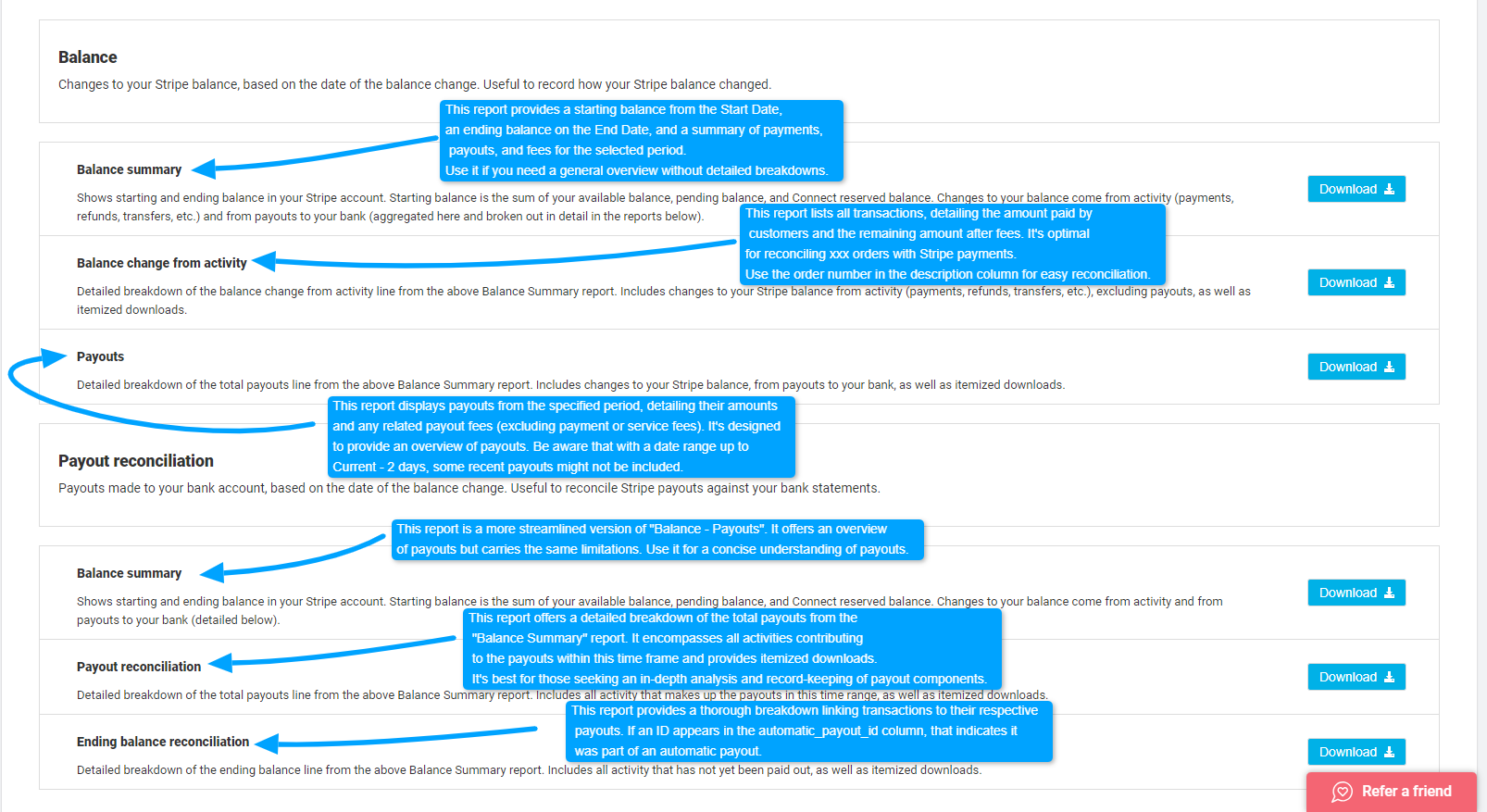

What kind of reports are available to me?

In addition to the various reporting options already available in the dashboard, GotPhoto provides reports that pull data from your Stripe account. These reports can be found by clicking on your name in the upper right corner, then selecting Finances, and then the Stripe Payments tab.

Please note: Reports are available with a 2-business-day buffer. This means you can only access a report for an order if more than two business days have passed since the order was placed. They can be used to reconcile your payments with orders and gain insights into your cash flow, among other things.

If you want to learn more about the available exports, please refer to this article, Stripe Express Reports. Click the image below for some additional guidance on choosing the appropriate export option.

FAQs

Can I change the statement descriptor shown on my customers' bank and credit card statements?

Yes:

- On the Online Shop page, click on Payment Methods.

- Then click the blue Modify button.

- On the following page, enter your preferred text under Statement Descriptor, and then click Save.

Is there a way to grant more people access to my Stripe Express dashboard?

Yes, on your Stripe dashboard, navigate to the user icon on the top right, then to your platform settings. There you will find the option to add additional users. Learn more here.

Do I have the option to send an invoice or request payments via my Stripe Express dashboard?

No, currently those two options are not available on your Stripe Express Account. Alternatively, you can use your other regular Stripe account if available for this purpose.

Can I have API access to my Stripe Express account?

Access to your Stripe Express account via API is not available at this time. However, there is a possibility of reconsideration in the future, depending on the support provided by Stripe. Please know that this doesn't impact API access to your GotPhoto account, only Stripe.

What does 'open' mean under payment in my GotPhoto account?

The "open" status indicates that payment for the order has either not yet been received on Stripe, or has not yet been approved on GotPhoto. This process occurs automatically, typically within 24-48 hours of the order being placed. To finalize the order, you can send a payment reminder link from the order page right-hand panel. This will send your client a direct link to where they can submit the necessary payment and settle the bill. If you review your Stripe dashboard inside of GotPhoto, and find that the payment was received by Stripe, but still shows as open on GotPhoto, support by our Customer Care team is required.

The takeaway

Streamline your transactions with Stripe Express on GotPhoto. Unlock new payment options, enjoy reliable security, and leverage integrated features for seamless order processing.

Related articles